honeygrow Simplifies Payment Management with Olo Pay

honeygrow is scaling at a rapid clip. The East Coast-based stir-fry and salad concept currently operates 42 locations and is slated to open 16 more in 2024 and another 20 in 2025. The brand’s growth strategy hinges on a streamlined tech stack to process nearly 100% of its orders, manage payments, offer guests a fully customizable dining experience, and simplify daily operations. Since adopting Olo Pay for on- and off-premise transactions, honeygrow has increased payment reporting efficiency, guest satisfaction, and its authorization rate. Additionally, it has significantly reduced fraudulent orders and chargeback costs.

PRODUCTS AT PLAY

7.4%

Increase in authorization rate for card-not-present transactions

$123K+

potentially fraudulent orders prevented on card-not-present transactions

82.86%

Reduction in chargeback costs

Background

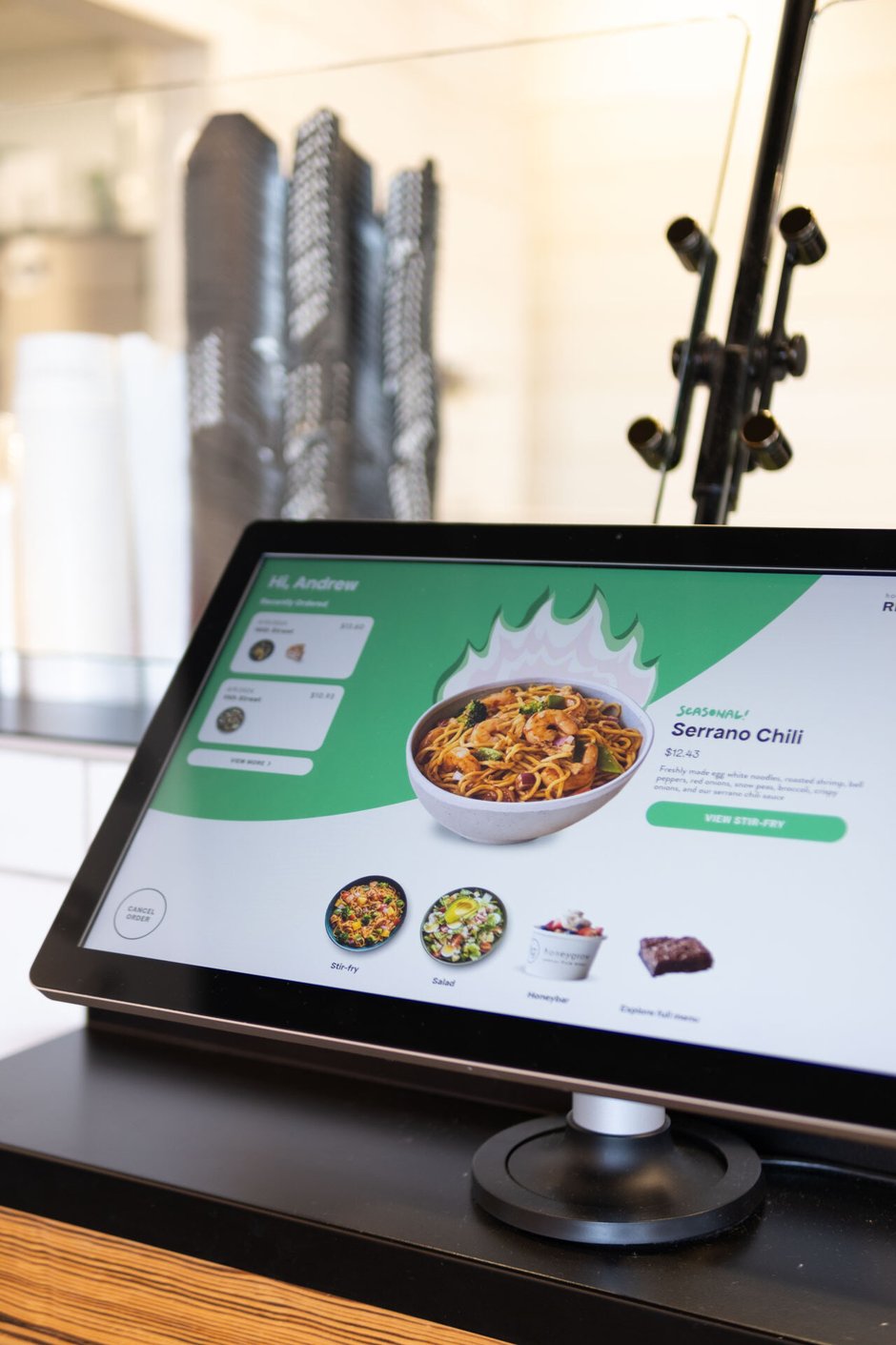

Since opening in 2012, honeygrow has been a digital-first restaurant. In addition to offering web and app ordering for pickup or delivery, all on-premise orders are placed via kiosk so guests can fully customize their stir-fry, salad, or honeybar dessert to suit their palate and dietary needs.

To simplify its tech stack and allow operators to perform their daily functions more easily, the brand implemented several Olo solutions—Ordering, Rails, Dispatch, Catering, Order with Google, and Olo Pay. Today nearly 100% of honeygrow orders go through Olo.

honeygrow was the first restaurant to adopt Olo Pay for both on- and off-premise transactions and has since processed hundreds of thousands of payments across 42 locations. By aggregating both types of payments alongside digital ordering within the Olo platform, the brand has benefited from simplified refunding, voiding, and reconciliation, as well as a high authorization rate and low fraud rates.

Results with Olo

01

FEWER FRAUDULENT ORDERS AND MORE REVENUE

Despite the increasing sophistication of fraud attacks across e-commerce, Olo Pay has blocked 99.99% of fraudulent orders while increasing honeygrow’s authorization rate from 91% to 97.75% for card-not-present transactions.

The brand has seen its chargeback costs plummet by 82.86%. honeygrow only spent $600 of its $3,500 budget for chargebacks since switching to Olo Pay—and has saved an estimated $123K+ in potentially fraudulent orders.

02

INCREASED EFFICIENCY AND SIMPLIFIED PAYMENT MANAGEMENT

With orders and payments aggregated in one platform, honeygrow has gained data clarity and increased efficiency. The brand can tell exactly where each guest ordered and how they paid, and can easily issue refunds—without jumping between systems.

Payment reconciliation has also improved dramatically, much to the excitement of honeygrow’s accounting department. Before Olo Pay, one accountant had the full-time job of manually matching orders to payments. Olo’s streamlined payment platform, which makes it easy to match orders to payments, has freed that person up to focus on more important business objectives.

03

HIGHER GUEST SATISFACTION

Since implementing Olo Pay, honeygrow has seen a reduction in confusion and complaints from guests regarding payments and refunds. Operators can more confidently answer guest questions, 86 menu items, and connect the dots between orders and payments.

Guests benefit from a seamless payment experience via EMV-compatible hardware—including tap-to-pay and mobile wallet support—and can rest assured valid transactions and refunds will be processed securely and promptly.

We want to be in the stir-fry and salad business, not the payment processing business. We’re saving a great deal on chargeback costs, plus we increased efficiency, guest satisfaction, and our authorization rate. We have so much more confidence now that the payment experience will be on par with the high standards our guests have grown to expect from honeygrow.

John Paul Thomas, VP of Operations

honeygrow

More customer success

Pasqually’s

Olo Rails and Dispatch power growth, efficiency for Chuck E. Cheese virtual brand

Read case study

CKE (Carl’s Jr. and Hardee’s)

Carl’s Jr. and Hardee’s Enter New Era of Digital Hospitality With Olo

Read case study

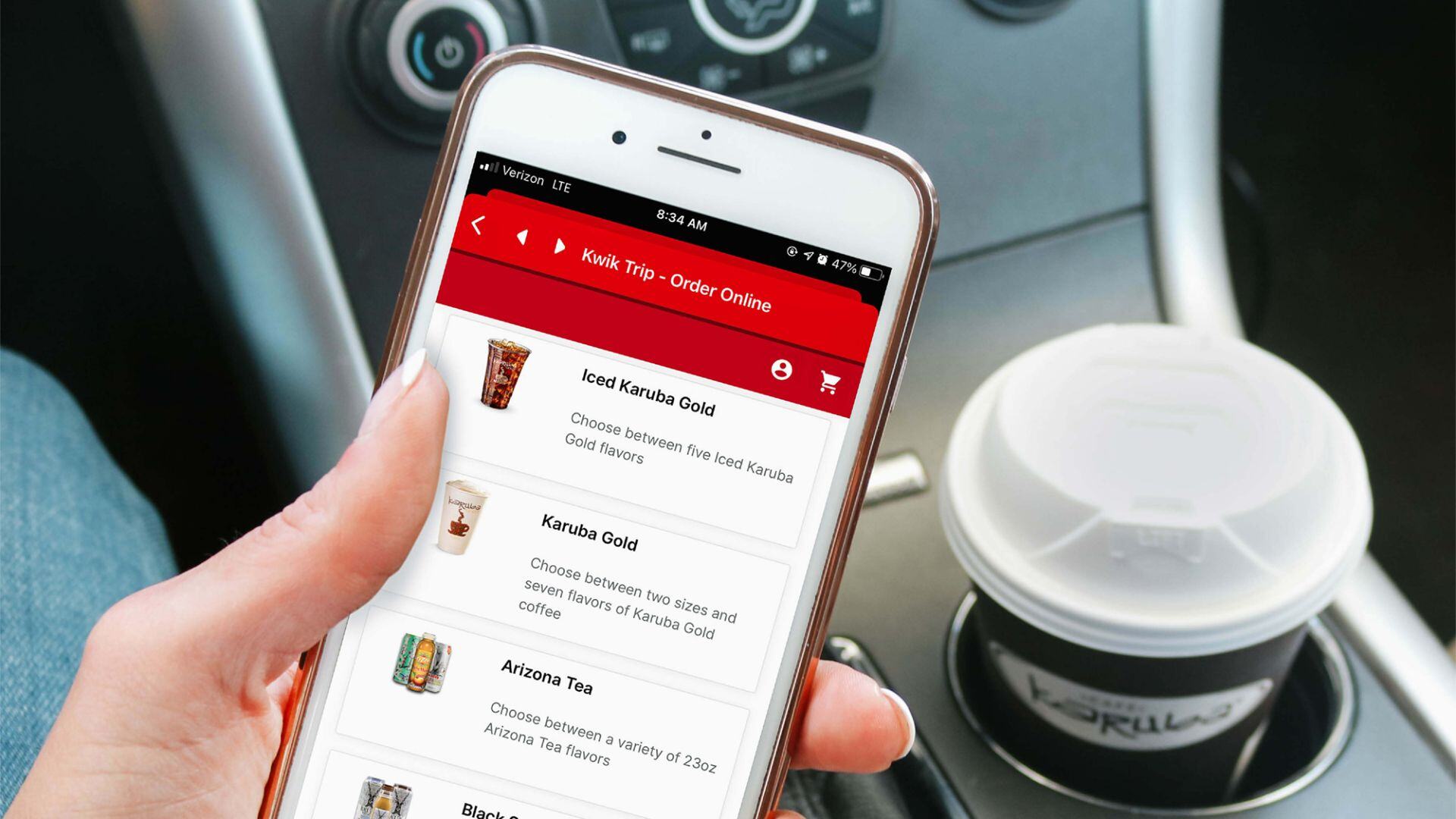

Kwik Trip

Mobile ordering and delivery boost convenience store sales, efficiency, and relationship with guests

Read case study