.png)

Switching to Olo Pay Saved $700K in Fees, Enabled 48-hour Onboarding, and Increased Sales with a Streamlined Guest Experience

Costa Vida is dedicated to delivering fresh, flavorful Mexican cuisine with a commitment to quality and operational excellence. However, the company was frustrated with its payment software. The platform was charging too many fees, required too much lead time to implement in the fast-paced restaurant world, and siphoned attention that could be focused on guests. Costa Vida switched to Olo Pay and immediately saw significant cost savings, increased orders, and an improved guest and operator experience.

PRODUCTS AT PLAY

$700K

Annual savings on processing fees alone

16%

Bump in digital sales system-wide due to digital wallet access

11%

Increase in authorization rate

2–3

Day onboarding, compared to 6 weeks

Background

Costa Vida was frustrated by its payment processor for two reasons. First, even with the partner’s required lead time of six weeks to implement, Costa Vida experienced delays because the payment system wasn't ready. Delaying store openings, particularly as the brand was growing and expanding to new areas, was detrimental to the brand’s image—not to mention the bottom line.

Second, the payment processor wasn’t transparent about its cost structure and fees. Costa Vida had negotiated an upfront processing rate, but was hit with exorbitant additional and hidden fees that made the true cost far higher.

Furthermore, the processor didn’t accommodate digital wallets, and Costa Vida suspected it was losing out on sales because the guest needed to physically enter a credit card number to make a purchase.

Costa Vida already relied on Olo for ordering and catering as well as first-party and marketplace delivery. After comparing other payment processors, Costa Vida was impressed by Olo’s reasonable price structure and easy integration. The brand decided to do a 30-day trial of Olo Pay in five stores. Even in that short timeframe, the results were clear: Olo saved Costa Vida money on processing fees and made it easier for guests to place orders. The team also noticed improved authorization rates and fewer fraudulent charges. Costa Vida then rolled out Olo Pay to 87 locations in one day.

In the first year, Costa Vida is on track to save $700,000 on processing fees alone. Thanks to Olo Pay's transparent pricing structure, Costa Vida can accurately budget without the unpleasant surprise of hidden fees.

The brand also saw savings from decreased fraudulent charges and a high dispute win rate. Olo Pay increased the amount of valid transactions that got approved, improving the authorization rate by nearly 11%, and practically eliminated fraud and chargebacks across all of their locations.

Olo Pay also gave Costa Vida access to digital wallets, which made ordering a more seamless experience for guests that led to increased orders.

Moreover, staying within the Olo product family simplified operations for the Costa Vida team. Rather than vetting a new vendor that might cause the same issues, the brand could simplify processes with fewer vendors and integrated systems. The team knew they could rely on Olo for true partnership and exceptional customer support.

Results with Olo

01

COST SAVINGS AND TRANSPARENT PRICING

02

48-HOUR DEPLOYMENT WITH EXCEPTIONAL CUSTOMER SERVICE

Costa Vida’s previous payment provider required six weeks’ notice to set up a new store—and even with that lengthy timeframe, the vendor missed deadlines and caused delays to opening. With Olo, stores could be up and running on Olo Pay within 2–3 days.

03

MORE ORDERS, MORE GUESTS SERVED

Olo Pay provides a better experience for our guests and significant savings for us. Instead of worrying if a store's payment systems will be ready, or if I’m going to experience fee surprises later in the year, I can focus on serving our guests. Olo is a true partner in operational excellence with Costa Vida.

Allen Beck, Director of Off-Premise and Catering

Costa Vida

More customer success

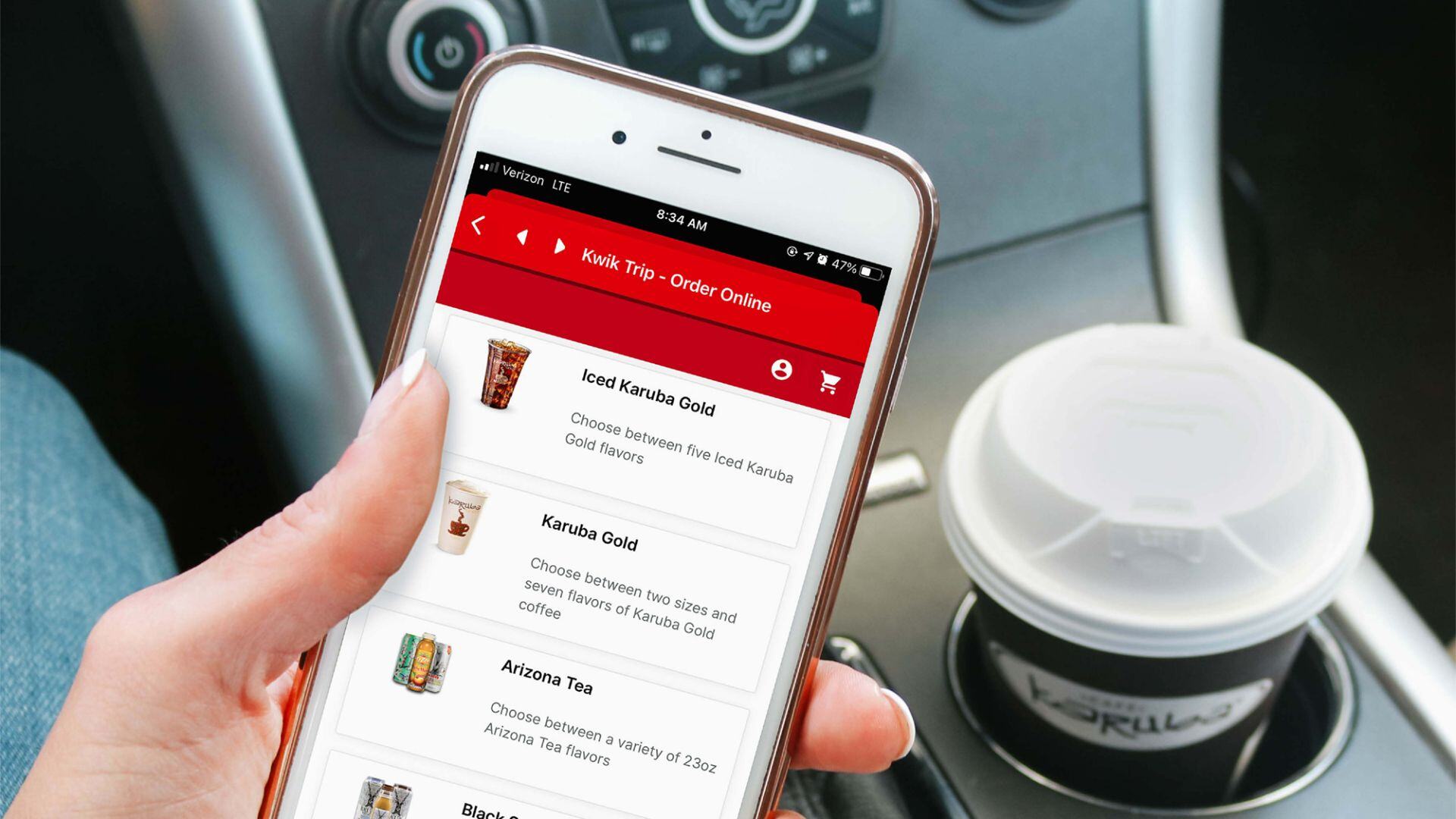

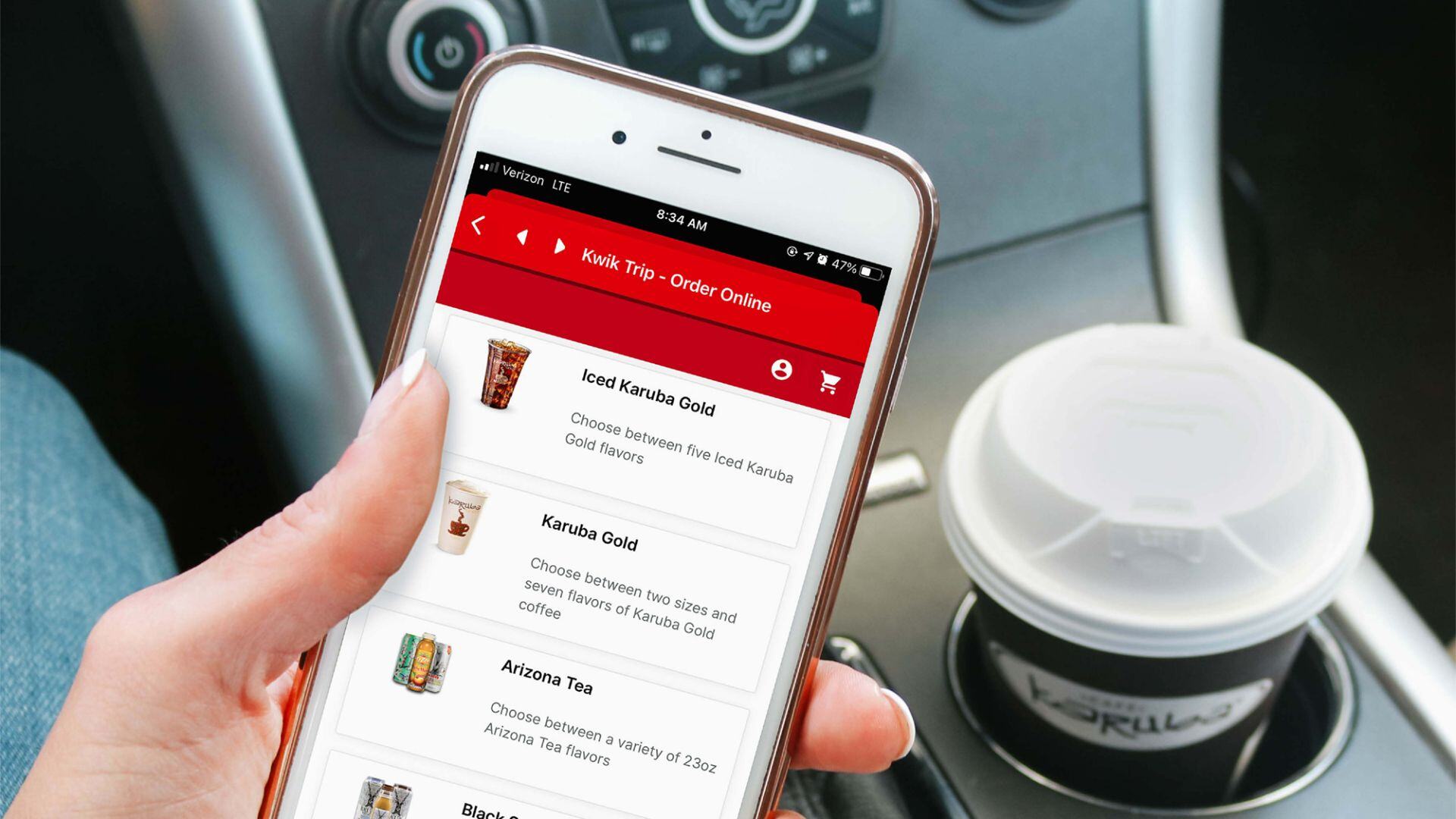

Kwik Trip

Mobile ordering and delivery boost convenience store sales, efficiency, and relationship with guests

Read case study

Kwik Trip

Mobile ordering and delivery boost convenience store sales, efficiency, and relationship with guests

Read case study